The general overview on the financial report quality had been studied by many researchers. Therefore, an agreement had been created to support the convergence of accounting standard harmonization that will be impacted within the financial reporting. Some phenomena occurred in an accounting scandal in the early 21st century, which showed us the weakness in the financial reporting quality (FRQ). The financial report quality depends on the value on the accounting report; hence, it is important for a company to provide a high-quality financial report. Research shows that a quality financial report will be both impactful and useful in making an investment decision. The concept of a quality financial report is not only for containing financial information but also non-financial, which will be useful in making an economic decision (Herath et al., 2017; Asyik et al., 2022).

- They could rely on the numbers to make intelligent estimates of the magnitude, timing, and uncertainty of future cash flows and to judge whether the resulting estimate of value was fairly represented in the current stock price.

- We must all ensure that they have the tools and the abilities to perform their important functions.

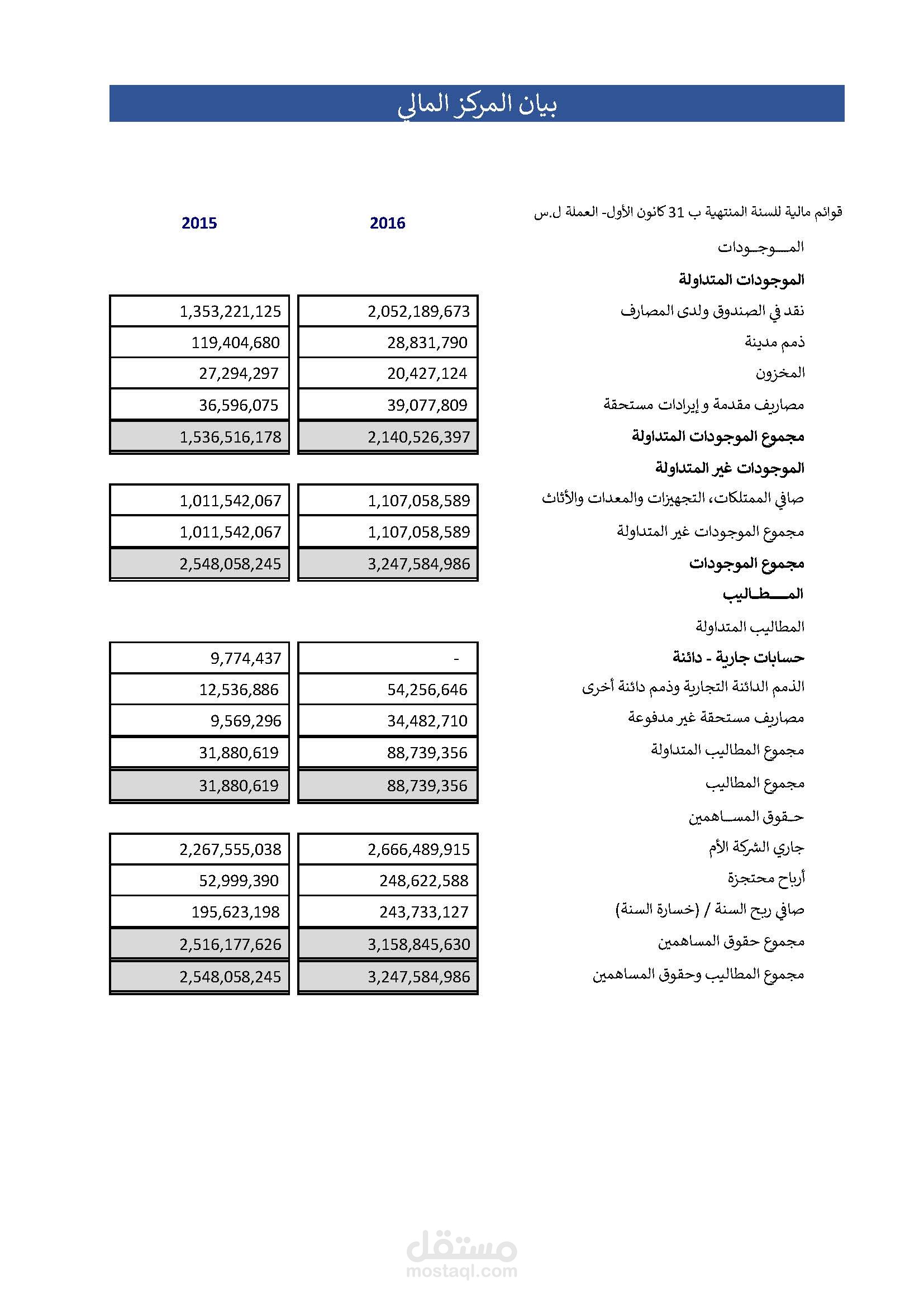

- Therefore, financial reports must be presented accurately, comparably, be verifiable, on time and understandable.

- The objectives mentioned above indicate that financial reporting is essential for decision-making among both internal or external users.

- Despite our strong trading momentum, there is much more opportunity for future growth and that energises us.

Accounting: Art, Not Science

The goal of the staff’s initiative is to make disclosure more effective, which is not only about reducing volume and complexity, but also considering whether investors need more information in certain areas. The staff is considering all of these issues in its review, and I encourage companies to continue to undertake their own efforts to enhance disclosures for the benefit of their investors. Last week, a transportation bill was enacted that contained a number of SEC-related provisions, including one for disclosure modernization and simplification. Among other provisions, the Commission is required to study the requirements in Regulation S-K, report the findings to Congress, and issue a proposed rule to implement the recommendations of the study. Investopedia’s Glossary of Terms provides you with thousands of definitions and detailed explanations to help you understand terms related to finance, investing, and economics.

Data availability

The scope of financial statements extends to internal teams and external parties such as investors. With financial statements businesses can monitor their performance, develop strategies for the future, and comply with regulatory requirements. These statements also help cement trust and confidence between the business and other involved parties. There are many ways to gauge the quality of earnings by studying a company’s annual report. Each country or region has its own rules and regulations covering different aspects of accounting, financial reporting, auditing, etc. In our time this morning, I have tried to give you an overview of how the SEC views our shared responsibility for strong financial reporting and to highlight some of the reporting issues that have our attention.

The Quality of Financial Statements: Perspectives from the Recent Stock Market Bubble

The P&L statement records all of a company’s revenues generated from primary operations, for example, sales of products or services and distinguishes them from non-operating revenues, such as interests or rents. The statement also lists operating expenses like the cost of goods sold (COGS), salaries, rental payment utilities, and repairs, and non-operating expenses such as interest payments. Let me now turn to the importance of standard setters to high-quality, reliable financial reporting.

Timeliness:

Many articles and books on financial statement analysis take a one-size-fits-all approach. Less-experienced investors might get lost when they encounter a presentation of accounts that falls outside the mainstream of a so-called “typical” company. Please remember that the diverse nature of business activities results in a diverse set of financial statement presentations.

Which Earnings Calculation Is Considered More Reliable?

Working down the income statement, analysts then might look for variations between operating cash flow and net income. A company that has a high net income but negative cash flows from operations is achieving those apparent earnings somewhere other than sales. The higher sales volatility of a firm is resulted in low quality of financial report, hence, low firm’s valuation. The longer of a firm’s operational cycle is resulted in low quality of financial report, hence, low firm’s valuation. Financial reporting is the preparation of Financial Statements that communicate information on an enterprise’s economic activities and its financial objectives during a specific period. It provides a range of Cash Flow, performance, and position reports to enable decision-making by investors, creditors, management, and other stakeholders.

A company’s quality of earnings is revealed by dismissing any anomalies, accounting tricks, or one-time events that may skew the real bottom-line numbers on performance. Once these are removed, the earnings that are derived from higher sales or lower costs can be seen clearly. The information provided in the financial statements must be relevant to the needs of its users.

Investors depend on comprehensive and accurate financial reporting, and so our fundamental objective is to raise the bar of compliance by issuers and their auditors and we will use all of our tools to do so. At this conference last year, Jim Schnurr discussed the possibility of allowing domestic issuers to provide IFRS-based information as a supplement to GAAP financial statements without requiring reconciliation. This proposal has the potential to be a useful next step, and the staff has now developed a recommendation for the Commission’s consideration, which staff will be discussing with all of the Commissioners so that we can determine the path forward.

The IASC changed to the IASB to answer the challenge of how financial reporting should be carried out and further develop high-quality and global accounting standards, namely IFRS (International Financial Reporting Standard). The world’s great demand today is to be oriented towards one reporting standard that applies globally so as to increase the credibility and usefulness of financial reports as well as financial your adjusted gross transparency. In 2000, the International Organization of Securities Commissions recommended that global securities regulators permit foreign issuers to use IAS for cross-border offerings (IOSCO, 2000). Since 2005, nearly all publicly traded companies in Europe and numerous other nations have been required to produce financial statements in accordance with International Financial Reporting Standards (IFRS).

These factors help to achieve FRQ and are able to provide a positive response to the market. On the other hand, static factors (firm’s age, FA) and institution risk factors (leverage) are not able to produce FRQ. In conclusion, financial statements are important documents that give an in-depth and transparent overview of how a firm is performing financially.

In a fundamental sense, good financial reporting cannot occur without strong, first-rate accounting standards established by independent standard setters. The quality and value of financial reporting would be seriously diminished if based on—and audited against—subpar accounting standards. In a perfect world, investors, board members, and executives would have full confidence in companies’ financial statements. They could rely on the numbers to make intelligent estimates of the magnitude, timing, and uncertainty of future cash flows and to judge whether the resulting estimate of value was fairly represented in the current stock price.